There are a variety of great reasons to go with a Variable Rate Mortgage, here are the ones I focus on:

1) More Borrowing Power – Today’s Stress test on a Variable Rate mortgage is still 5.25%, whereas a FIXED rate requires a stress test rate of 6.40%-6.80%. This can equate to thousands more in borrowing power! E.g. A client earning $100K takes a 5 year FIXED RATE today – they qualify for $450K Mortgage. If this same client takes a VARIABLE rate, they qualify for $510K Mortgage – that’s $60K more house!!!!

2) Historically less interest paid … see Prime Rate Chart and Historical Comparison Chart. Although Prime is moving quickly NOW, we are being told it will likely level and will likely not catch up to what the fixed rates are currently priced at. Even if it does catch up, it takes time to do so and in the meantime you are paying less interest.

3) Lower penalty should rates drop back down again – Variable rate mortgages come with a 3 month interest penalty and NEVER IRD.

4) Opportunity to float back DOWN, which it always does eventually! If we see a recession next year, which some economists are predicting, we could see rates come back down – you do NOT want to be locked down and paying large penalties in order to take advantage of it.

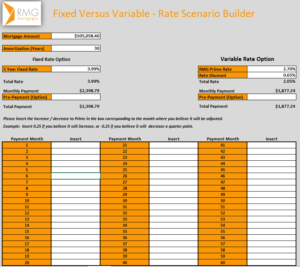

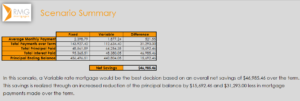

***Here is another spreadsheet I use often – it is designed to run hypothetical scenarios of multiple prime changes throughout the 60 months based on the client’s assumptions.

***Both amortization schedules are then compared to analyze the findings and make a recommendation into a dynamic sentence that changes based on the data:

Call me if you would like me to run any numbers thru this calculator!