It can get pretty exciting to see campaigns around “cash-back mortgages” but, before you get too far along, here are three things you might not know about these types of mortgages:

- Occasionally you will see campaigns on cash-back mortgages, so don’t jump at the first one you see! These types of mortgages are available through a few major lenders so it can be helpful to shop around to see what different terms and conditions are available, as this will affect the overall loan.

- When it comes to cash-back mortgages, you’re really getting a loan on top of your mortgage. The interest rates are calculated to ensure that, by the end of your term, you will have paid the lender back the money they gave you (and perhaps a bit extra!). Be mindful that these loans can come with higher interest rates and, in some cases, the extra is more than you got in cash-back.

- The average cash-back mortgage operates on a 5-year term. While you may not be planning to move before your term is up, sometimes things happen and it is important to be aware that if you break a cash-back mortgage, you have to pay the standard penalty but you will also have to pay back a portion of the loan you were given. For example, if you are 3 years into a 5-year term, you would have to pay back 2 years or 40% worth of the cash-back. Combined with the standard mortgage penalties for breaking your term, this can add up if you’re not careful!

- Cashback funds can NOT be used for down payment, but can be used for closing costs.

- Before signing for a cash-back mortgage it’s better to discuss your needs with a Broker first. We can advise regarding all cash-back mortgage availability, lines of credit, purchase plus improvement loans or also flex down mortgages that may be better for your situation.

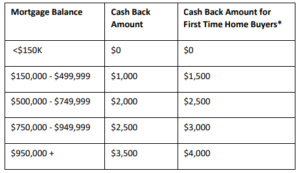

- There are currently cash bouses being offered by certain lenders – these are not considered a cash back mortgage, and do not come with the claw-back rule. The amount of this bonus is dependant on the Mortgage amount being taken – here is an example of what we are seeing: