Let’s get right down to it – today I am going to chat about the Collateral Mortgage Charge. Collateral mortgages have had a bad rap when they first came out, but to the right client they do come in handy:

- if there is a good amount of equity in the property that you feel you could need access to at some point during your existing term, or

- if you would like to create various components to your mortgage (hybrid)

What are the pros of a collateral mortgage?

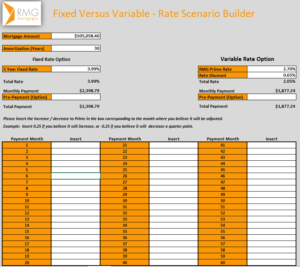

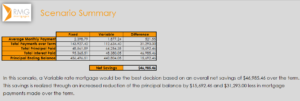

- In today’s uncertain market, a lot of clients are wanting to hedge their bets and diversify their risk products—i.e., hybrid (part fixed / part variable) mortgage. A hybrid simultaneously protects against the risk rates may have to rise significantly, while offering the chance to overweight in a variable when appropriate (e.g., a 65/35 variable/fixed split) to potentially take advantage of cyclical peaks.

- The flexibility to borrow money from your home at any time, and

- The ability to avoid the legal costs associated with refinancing

What are the cons of a collateral mortgage?

The downsides include:

- The need to pay legal fees if you switch to another lender, even if your mortgage is up for renewal – IF you are put into a Collateral Mortgage without enough equity to take advantage of it’s “perks”, then this product is simply a TRAP, making it more difficult and expensive to shop the market on renewal.

- By having a larger amount registered, you may have a tough time securing financing for other things as it looks like you owe more than you do.

- If you need access to equity; but can not qualify for the increase, the ability to obtain a 2nd mortgage with another lender is affected – the 1st mortgage lender must be willing to “cap” their lending amount, which in my experience has proven to be difficult with most banks, and impossible with others.

How is a collateral mortgage calculated?

If you choose to get a collateral mortgage, the lender may be able to register your mortgage for up to 125% of the value of your new home – let’s call it a “GLOBAL LIMIT”.

E.G. $800,000 home value x 125% max loan-to-value ratio = = Global limit: $1M

When the time comes that you want to access your equity, you can now refinance / borrow up to 80% of whatever the new appraised value is – as long as it does not exceed the Global Limit – without incurring legal fees

Which lenders offer collateral mortgages?

Most lenders offer collateral mortgages – or at least give you the option of taking one. Anytime you see a lender who allows customers to divide their mortgage into multiple segments, such as a long term or short term, fixed rate or variable rate, and/or a line of credit, is registering as a collateral mortgage. E.g. RBC HomeLine, Scotia Step, Manulife ONE, TD Flex-line to name a few.

Like anything in life, we are always best served by dealing with an individual that is a FOCUSED EXPERT in the field in which we need information… call me anytime.

Have an amazing week!

Janette Roch, MBI

CELL: 250 588 1919